Long gone are the days of mining Bitcoin (COIN, OTCQX:GBTC) with your PC’s GPU or CPU. Roughly 8 years ago, when cryptocurrency was a teething industry and not a household name like today, a personal computer could mine 200 BTC in just three or four days. Nowadays, using the same processing power, it would take you over 100 years to mine just 1 BTC. (Source: What is Bitcoin Mining for Beginners - Short and Simple.)

The Bitcoin infrastructure is reliant on miners for integrity and stability, so it is beneficial for Bitcoin to be mined in a slow trickle, as there is a limited supply. This is due to the increasing mining difficulty, which ensures the same amount of BTC is being produced every 10 minutes no matter how many miners are active.

This increase in difficulty led to the use of Application Specific Integrated Circuit (ASIC) computers. These are extremely powerful machines that are specifically designed to mine bitcoins at a massively increased rate over just using your personal computer. Buying one of these however, does not instantly grant you all the Bitcoin that you wish for as you are still only mining a fraction of a Bitcoin every year with one of these machines.

Antminer S9, bitmain.com

Antminer S9, bitmain.com

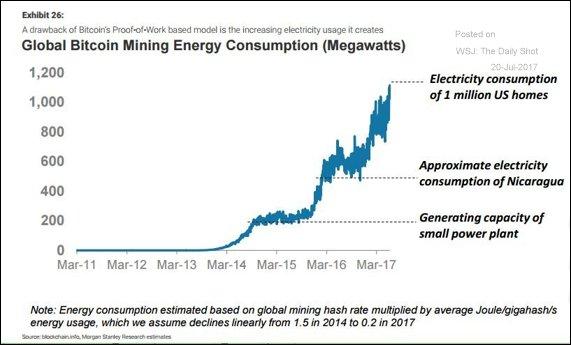

The main point that turns off rookie crypto enthusiasts from mining is the electricity costs incurred with mining. The proof of work system pushes your mining hardware to the limit, devouring electricity while it does so.

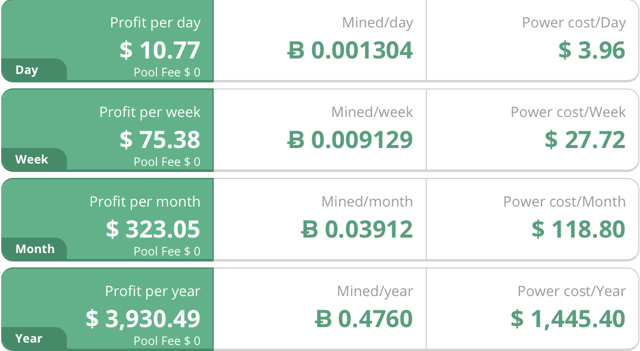

One of the newest ASIC mining machines on the market at the moment is the Antminer S9, produced by a company called Bitmain. These are still in high demand and difficult to buy at the base price of $2,320, with the price of second hand or resellers averaging at $3,000, sometimes reaching in excess of $5,000. Using the specs from the Antminer S9, and the average US cost of $0.12 per KWh, you can calculate that you will make an estimated $3,930 profit a year (At Bitcoin’s current price).

This leaves you with an extra $930 for the first year if you take out the initial investment for the machinery. (Source: batmain.com, Mining Calculator Bitcoin, Ethereum, Litecoin, Dash and Monero.) All prices do not include the fee added by a mining pool, if you wish to use one.

Antminer S9 profitability calculator, cryptocompare.com

These prices also do not include the extra energy needed for cooling systems, as this mining hardware emits large amounts of noise and heat, which only increases with the more miners you have in your rig. Some other issues that might arise are power surges/outages and overheating.

This overall complexity can make even the most avid newcomer to the crypto world apprehensive to mining. As you can see, the profit calculation for mining is quite convoluted and can be highly variable. The biggest factor is obviously the price of Bitcoin. Since Bitcoin has gone up dramatically in price, it has drawn many miners who previously could not mine profitably.

(Source: Bitscreener.com)

Environmental Concerns

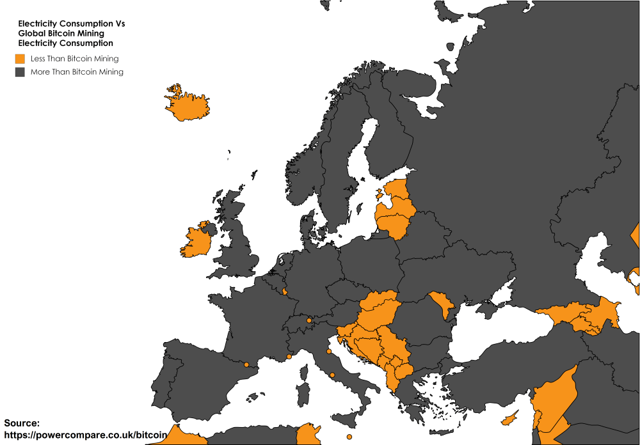

While the total global electricity consumption used by the Bitcoin ecosystem is not entirely known, it has been estimated by cryptocurrency blog The Digiconomist at 32.56 terawatt hours (TWh). (Source: Bitcoin Energy Consumption Index - Digiconomist.) In comparison, the Republic of Ireland used a total of 25.07 TWh in 2015. (Source: Bitcoin Mining Now Consuming More Electricity Than 159 Countries Including Ireland & Most Countries In Africa.)

China is currently estimated to be mining roughly 60% of all new Bitcoins. (Source: 3 Things to Know About Bitcoin Mining in China.) This might be due to the relatively low cost of electricity in the country in comparison to others. However, due to recent rumors of crackdowns and regulations by the Chinese government on cryptocurrency, the future of these large-scale mining pools are in question. A shut down of mining operations in China would cause a decrease in new Bitcoin supply, which could lead to a surge in its price.

This would only be temporary as once 2016 blocks are mined, the mining difficulty is adjusted to keep Bitcoin production at a constant rate. (Source: China's Crackdown on Mining Could Lead to Bitcoin Price Surge.) The crackdown is all speculation at this time as no official order has been executed yet.

The hole left by the absence of Chinese mining operations might be short-lived due to relocation, with Bitmain Technologies having set up a subsidiary in Switzerland. (Source: Chinese bitcoin mining giant sets up Swiss subsidiary.) Other smaller companies may not be able to afford this due to higher energy costs abroad, which would greatly reduce profit margins from mining.

|

While some ill-informed skeptics of Bitcoin might say that this will eventually lead to the industry increasing its energy costs infinitely, this is far from the truth. Due to Bitcoin’s founder Satoshi Nakomoto’s process known as “Block Halving,” the amount of BTC that is awarded per block mined (Or every 10 minutes) is reduced by half every 4 years.

In 2009, 50 BTC was awarded per block, this has been reduced to 12.5 and will drop to 6.25 in 2020. This will theoretically lead to a reduction in energy consumption as the monetary reward will be less than the cost of running the large-scale Bitcoin mines. This process continues until the max amount of 21 million Bitcoin is in circulation.

Even when the final amount of Bitcoin has been reached, miners will still be able to make money from their systems, so the total amount of miners may be reduced but they will not be completely defunct. This is because there are transaction fees, which pay for a small fraction of Bitcoin to be sent to the miner whenever a user sends a transaction on the network. This is where the main source of income will come from miners in the future. (Source: What Happens to Bitcoin Miners When all Coins are Mined? - Bitcoin News.)

A potential risk to Bitcoin could be realized at this point if the transaction fees are not enough to keep mining operations afloat. Miners might migrate to mining other, more profitable coins. In theory, it would be easier for a hostile 51% computing power takeover of the Bitcoin network if only a fraction of miners are still active. However, we need not worry about this for a long time, as estimates are that the last Bitcoin will be mined sometime around the year 2140, as the number of Bitcoins rewarded tapers off asymptotically.

It seems that the crypto mining industry will not be going anywhere in the near future, with years of Bitcoin left to mine and plenty of altcoins that require mining as well. As crypto develops, people will find faster, more energy efficient ways to mine, which should prevent mining from causing a global ecological catastrophe. With that being said, a new blockchain paradigm is the ‘Proof-of-Stake’ model, where simply holding coins entitles you to rewards and does not require mining at all.

It remains to be seen which model will win out in the long run. For now though, keep an eye out for companies that have exposure to mining, such as Nvidia (NVDA) and Advanced Micro Devices (AMD). As we pointed out in a previous article, crypto mining is a small, but potentially high-upside area of chip producers’ market.

If you found this article helpful, please follow us for timely new content. If you have any questions or comments, let's have a discussion below. Thanks for reading!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 Response to "What Will Become Of Bitcoin Mining? - Winklevoss Bitcoin Trust ETF ... - Seeking Alpha"

Post a Comment